The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. The Student Loan Repayment Benefit is the name and it is being offered by employers who contribute a certain dollar amount per year toward paying off an employees student loans.

How Progressive Is Senator Elizabeth Warren S Loan Forgiveness Proposal

Expiration of child tax credit payments reflects.

. Is there relief for student loan debt during COVID-19. The 19 trillion stimulus package passed in March 2021 also known as the American Rescue Plan. By the end of March 2021 the estimated value of.

This includes private loan assistance programs like those offered to health care providers by the National Health Service Corps as well as refinancing and negotiating lower monthly payments. Student loans arent just a young persons problem. Universities in 2020 owed an average of 45000 in student loan debt.

Students who graduated from UK. Should I consider bankruptcy to. While private Navient student loans arent eligible for Navient student loan forgiveness there are some private student loan forgiveness options.

Suspended payments will appear as regularly rescheduled payments by credit-reporting agencies. We scored the company based on its co-signed credit-based student loan for. How the student loan relief extension came to be.

Individuals paying back federal student loan debt can defer payments and interest through May 1 2022 approved December 22 2021. President Trump said during his press briefing. The federal government created the Public Service Loan Forgiveness PSLF program in 2007 as a response to the ongoing crisis 45 million borrowers.

But many people have student loans because they. And thats great news for anyone thats had anything to do with the National Collegiate Student Loan Trusts or the debt collection agencies working for it because apparently theres about 5000000000 5 BILLION in student loan debt that the company has lost the records of and which may end up being totally discharged because of. Student debt has grown enormously more than doubling over the past two decades.

In 2022 Americans continue to be burdened by student loan debt. Most of the debt held by 50-plus borrowers is the result of the borrowers education. In World War I the United States Treasury made large loans to the allies that were postponed.

Among the class of 2020 55 of bachelors degree recipients took out student loans graduating with an average of 28400 in federal and private debtAnd 14 of parents with students in the class of 2019 the latest data available took out an average of 37200 in. We also suspended student loan payments for six months and were looking to do that additionally and for additional periods of time Aug. Trump formally directed the Education Department to carry out an extension through Dec.

Department of Education between March 13 2020 and May 1 2022. Theres a very good chance that you can qualify for a student loan discharge and maybe even for a refund for any payments youve already made toward your outstanding federal student debt related to. So far only 4 of US.

MONTPELIER Attorney General TJ. In a major announcement this week the Biden administration confirmed what many student loan borrowers feared. Under the CARES Act employers can contribute up to 5250 toward a workers student debt on a tax-free basis through the end of 2020.

On March 27 2020 the Coronavirus Aid Relief and Economic Security Act which is meant to provide emergency public health and economic assistance was signed into law. RISLA was a winner of Forbes Advisors best private student loans of 2020 awards. It means you are no longer obligated to repay part of or the total of your loan debt.

Navient will provide a total of 185 billion worth of student loan debt relief to hundreds of thousands. The federal government doesnt get much credit for its response to crisis situations but student loan borrowers have good reason to salute the feds for help in repaying their 17 trillion debt. UPDATED Tuesday March 24th 2020.

How to Qualify for the Everest College Lawsuit Student Loan Forgiveness or Discharge Benefits. Debt relief or debt cancellation is the partial or total forgiveness of debt or the slowing or stopping of debt growth owed by individuals corporations or nations. The Department of Education has discharged nearly 15 billion worth of student loan debt through executive action since President Joe Biden took office a.

Companies offer the perk but 8 of companies with 40000 employees or more have it. Under the new law no payments are required on federal student loans owned by the US. That student loan relief will end January 31 2022 and student loan.

At the end of 2020 43 million American borrowers owed a total of about 16 trillion in federal student loans with private student loans bringing the sum to 17 trillion. More than 11 months into his administration that. Best Debt Settlement.

Department of Education or through the Federal Family Education Loan FFEL Program automatically receive a new interest rate of 0 from March 13 2020. During the 2020 election then Democratic presidential candidate Joe Biden committed to canceling 10000 of student loan debt per borrower. At the end of 2020 borrowers age 50 or older held about 22 of the nations 16 trillion student debt burden the AARP reports.

Borrowers with loans owned by the US. From antiquity through the 19th century it refers to domestic debts in particular agricultural debts and freeing of debt slaves. A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees such as tuition books and supplies and living expensesIt may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school.

Updated for filing 2021 tax returns. Federal student loan servicers. The payments will not be considered a taxable benefit for the employee.

Student loan forgiveness is now tax-free. Donovan announced today that Navient one of the nations largest student loan servicers will provide 1680523 in debt relief to Vermont borrowers and. I have good news for Everest College students.

Biden Cancels 1 Billion Of Student Loans

Student Loan Forgiveness Statistics 2022 Pslf Data

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

What Biden S Election Could Mean For Student Loans The New York Times

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Comparing Student Loan Discharge And Student Loan Forgiveness

4 Signs That Student Loan Cancellation Isn T Off The Table

Is Student Loan Forgiveness Taxable It Depends

Student Debt Relief Programs Strategies

10 Questions About Biden S Plan To Cancel Student Loans

Senate Passes Stimulus Bill With Student Loan Tax Relief Will It Pave The Way To Cancel Student Debt

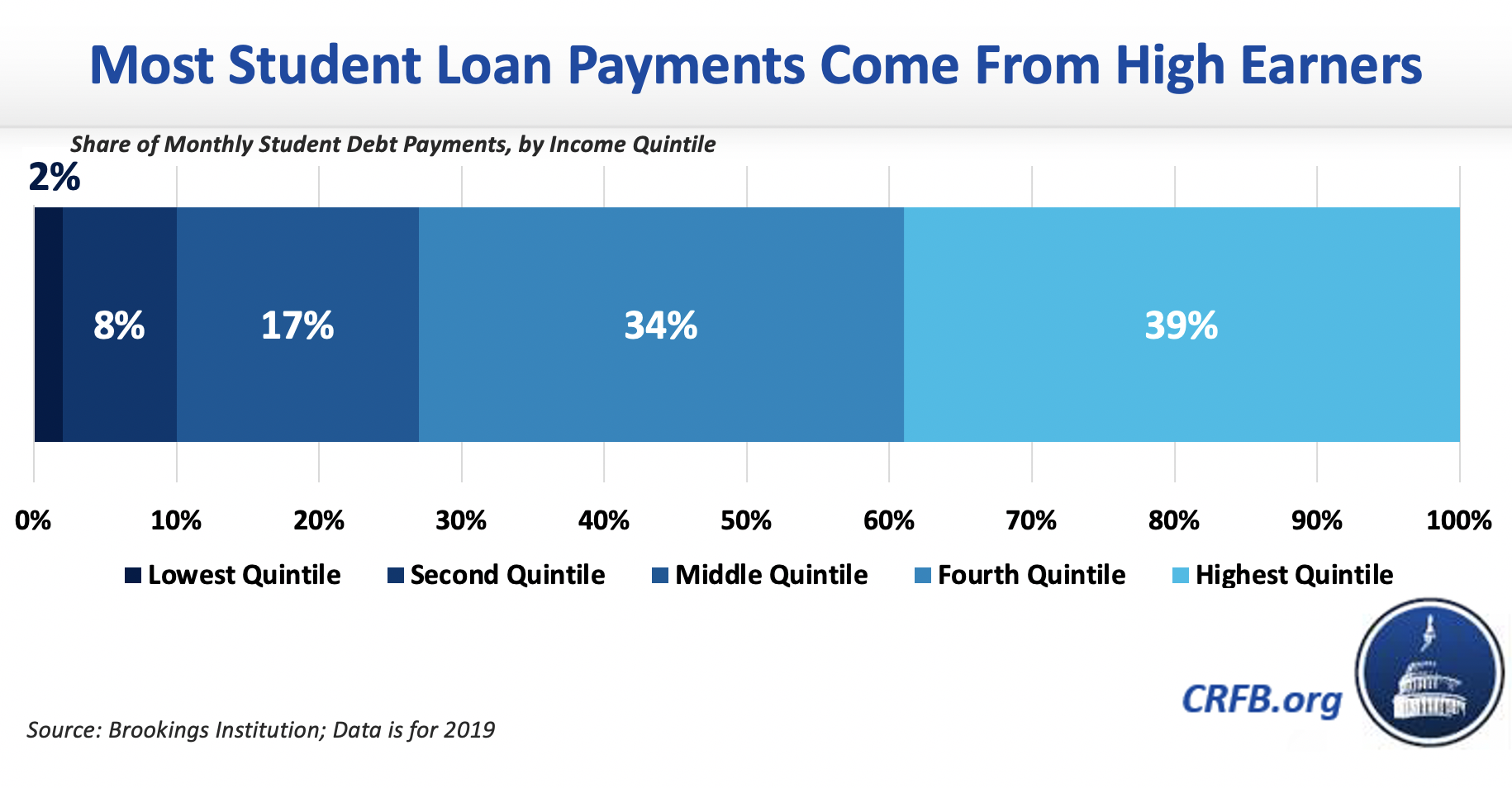

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Private Student Loan Borrowers Got No Relief During The Pandemic Nextadvisor With Time

What Is The Current Student Debt Situation People S Policy Project

Cancel Student Loans Your Questions Answered

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Chart Americans Owe 1 7 Trillion In Student Loans Statista

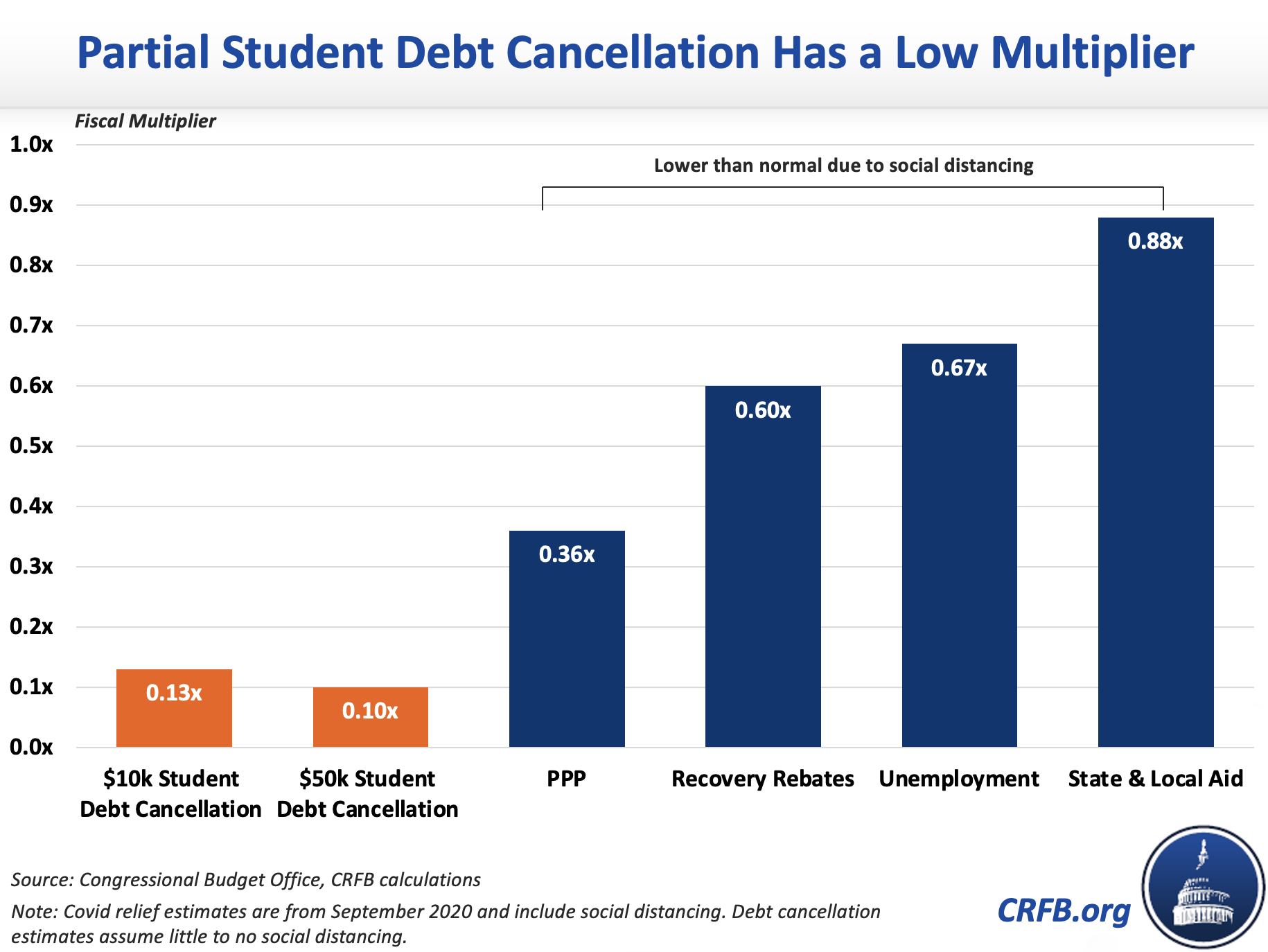

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way